This business entity is taxed as an individual based on the income of the proprietor. You might have guessed that if a sole proprietorship has a single owner then a partnership has two.

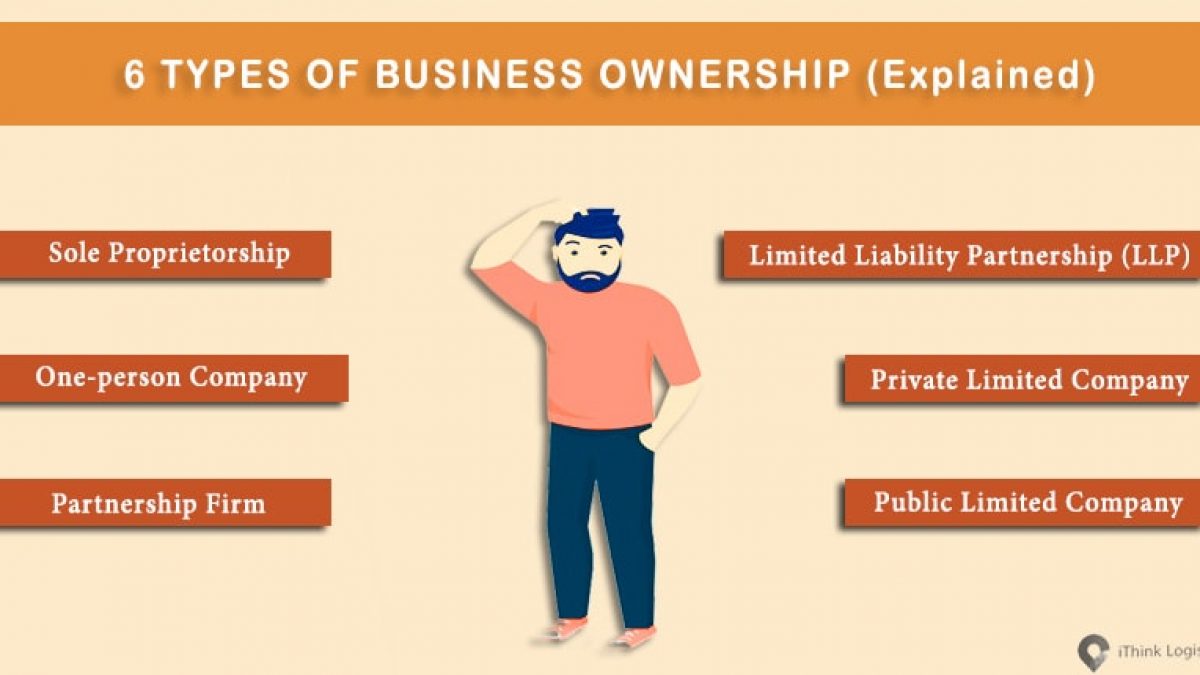

Types Of Business Ownerships In India Ithink Logistics

Sole Proprietorship vs Corporation.

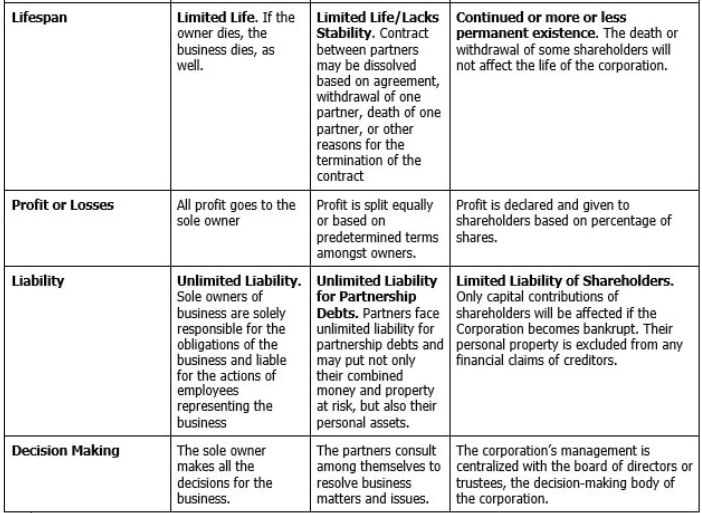

. The main difference between the two is the number of owners. The main difference between a sole proprietorship and partnership is the number of people who own and operate the business. The members involved in the Partnership are known individually as partners or agents of the firm while they are collectively known as a firm.

In a sole proprietorship all company profits and losses are reported under the personal tax return of its owner. Forming an LLC costs a lot of capital. Consequently the losses are also distributed among the members.

Youll pay tax on your share of business income the same way as a sole trader would. In a sole proprietorship if the owner dies or the business is sold the company is automatically dissolved. One of the main differences between sole proprietorship vs.

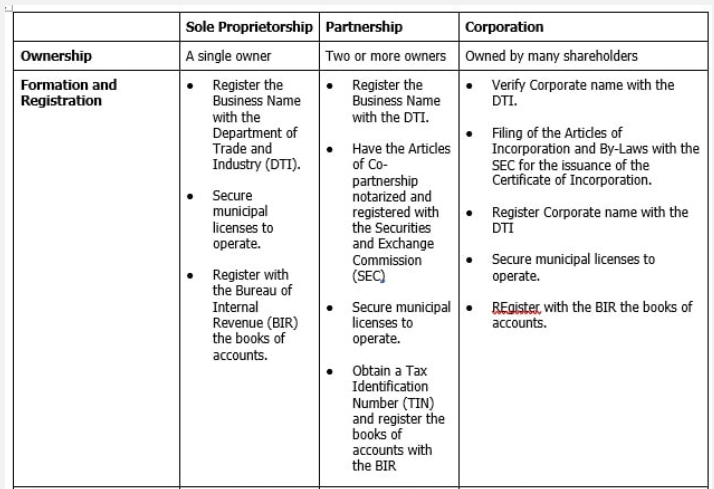

A partnership company has the same characteristics as a sole proprietorship except that it consists of more than one proprietor or partner and all partners share in the companys income and expenses. Yet here profits and losses are first distributed to the co-owners pro-rata to the equity interest and then each of them pays income taxes under their personal tax rates. Only Single Person is required for the Registration.

Partnership is the number of owners. The main difference between Sole Proprietorship and Partnership is that in a sole proprietorship there is only one member. The main difference between sole proprietorship and corporation is that sole proprietorship is handled entirely by one individual.

Heshe is responsible for handling the operations of the business. Each partner is an owner and has separately co-invested in the business. A sole proprietorship business is operated by one person.

A sole proprietor manages all business operations whereas members of a partnership all share in the general responsibilities of running the company. On the other hand a corporation refers to a large company. To start a sole proprietorship there are no fees borne by the owner.

The same is true for partnerships. A partner in the firm will be liable for the actions of the other members of the firm. The main difference between sole proprietorship and corporation is that sole proprietorship is handled entirely by one individual.

The basic difference between Sole Proprietorship and Partnership Firm is described below. In a partnership if an owner dies or withdraws from the business the company may automatically be dissolved. And while that is a very common form of partnership they can sometimes include more than two people.

The Proprietor or the business owner is responsible for all the business decisions. With a sole proprietorship you are the sole owner in some states your spouse may be a co-owner. The income is directly attributed to that person the Owner as business income.

The exception is a general partnership where the general partner runs the operations of the business and the limited partners are partners in capital investment alone. A partnership is different from a corporation because it is not. When you have a partnership you will work with at least one co-owner.

Here shareholders are the owners. Under the automatic approval road route foreign direct investment is allowed in a. There are many other differences between the two in terms of their business act ownership liabilities finance and freedom of operation.

Each one has its pros and cons and characteristics discover them in this post. Revenue and expenses are included in the in the Owners income tax return and the Owner is fully liable for all debts and. Number of owners.

Whereas in Partnership there can be multiple partners between two or 100. A sole proprietorship consists of a single owner. Heshe is responsible for handling the operations of the business.

There is no limit to how many people can be part of a partnership type of business ownership it just depends on the partnership agreement. An average price would be 100 t o 800. A partnership has the same rules as a sole proprietorship except that your business income is split with a business partner or partner s.

Sole proprietorships and partnerships are common business entities that are simple for owners to form and maintain. Here shareholders are the owners. On the other hand a corporation refers to a large company.

The business does not have a separate existence apart from the Owner. You can have Partnership Firm Registration with two or more members. A sole proprietorship is where.

LLC comprises one or more owners who might also be corporations business partnerships or foreign businesses. The profits of a partnership are taxed at 30 plus surcharge and cess as applicable.

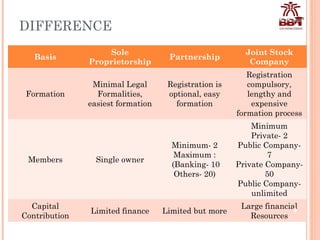

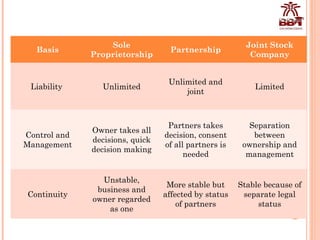

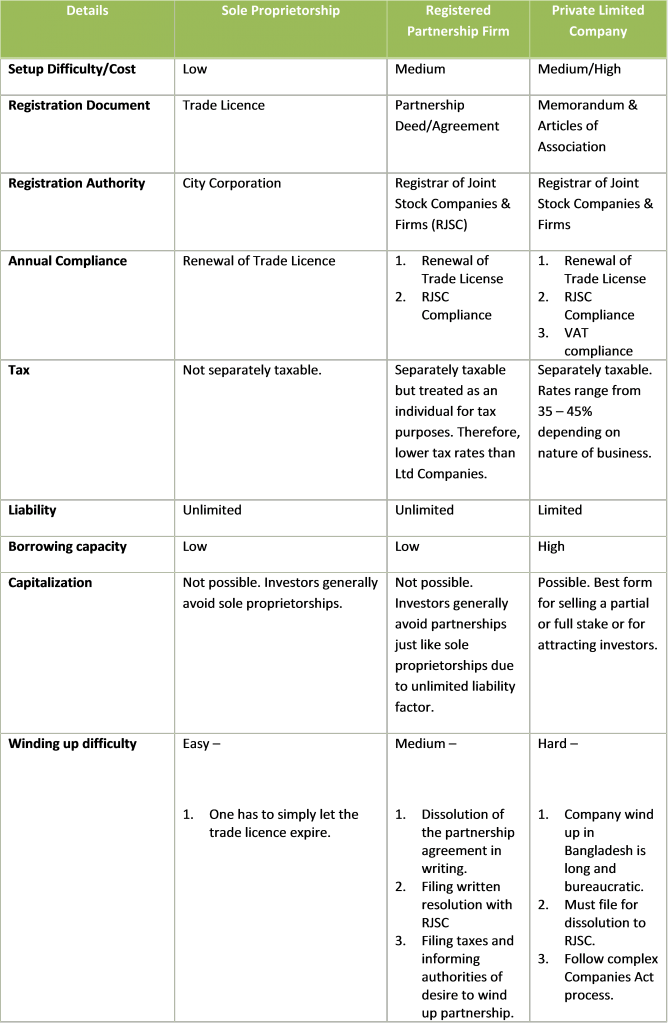

Difference Between Sole Proprietorship Partnership Joint Stock Com

Difference Between Sole Proprietorship Partnership Joint Stock Com

Difference Between Sole Proprietorship Partnership Joint Stock Com

A Few Things To Think About Before Starting A Start Up Lightcastle Partners

What Is The Difference Between Proprietorship And One Person Company Quora

Chapter 4 Forms Of Business Ownership Introduction To Business

Types Of Business Entities Comparison Chart Mycorporation

Differences Between Sole Proprietorship And Partnerships

What Are The Benefits And Disadvantages And Taxes Of Operating A Business As A Sole Proprietorship And Private Company Quora

Forming A Partnership Lexology

Forming A Partnership Lexology

Pdf Existence Of Sole Proprietorship In Business Activities In Indonesia Semantic Scholar

Business Entities Ag Decision Maker

Difference Between Sole Proprietorship Partnership Joint Stock Com

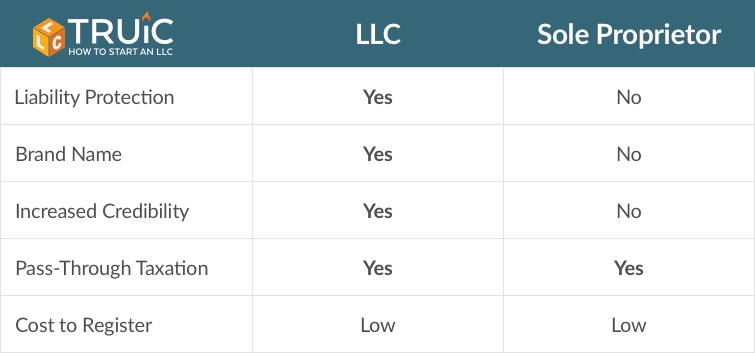

Difference Between Llc And Sole Proprietorship Truic

Learn About Proprietorship Chegg Com

Chapter 4 Forms Of Business Ownership Introduction To Business

Difference Between A Sole Proprietorship And A Partnership Tutor S Tips

Which Do You Think Is More Risky A Sole Proprietorship Or A Partnership Why Quora